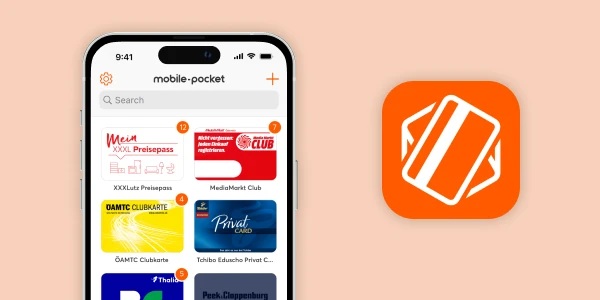

Mobile banking apps are an essential part of customer relationship for banks. However, customers expect these apps to be user friendly and have remarkable features. As specialists for finance technology and developers of the Loyalty & Rewards Platform mobile-pocket, we have evaluated a proof of concept for the Innovation Center of Intesa Sanpaolo on how they could extend their existing banking app through value added services.

The ideal place loyalty cards and for coupons

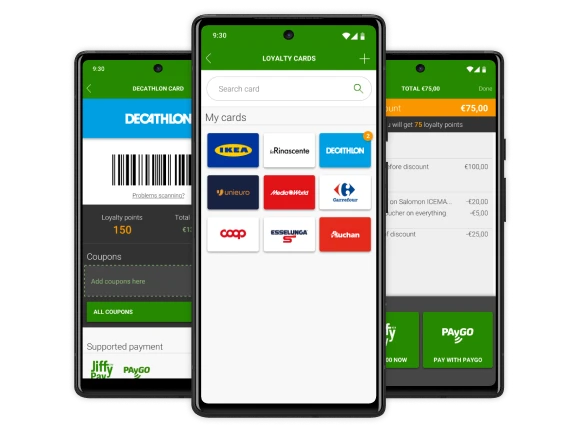

What would a digital wallet be without loyalty cards and coupons? Simply incomplete. For customers being able to digitize the loyalty cards of their favorite shops is surely an added value. The barcode/ QR code scanner or another input field for the card numbers opens with just one touch and soon the card is saved in the digital wallet. Where there is a loyalty card there are also offers; and of course, customers can view, activate, and redeem them.

Speed Shopping with One Step Checkout

The payment process at the end of the shopping tour is decisive for the whole user experience: it can ruin a first good impression or make up for a hitch. The One Step Checkout allows users to show their loyalty cards and coupon number at the cashier while paying, at the same time. This makes the mobile payment even faster and more practical.

Proof of Concept App

A native proof of concept, developed based on the existing banking app, served to better demonstrate the user experience. It represents both the use cases and the different user journeys – such as the start of the checkout process with the coupon activation. We have paid particular attention to the seamless interaction with the existing integrated payment system.